Cumberland currently offers all eligible care leavers an ISA after they have been in care for one year. This is managed via the Share Foundation, more information can be found through their website. For young people in Cumberland who are aged 16-18 and have such an ISA there is potential to increase your savings. If you engage in and complete the required modules of the 'Stepladder of achievement scheme' you can potentially add another £1800 to the account. To apply for the scheme

Cumberland Council offers a junior ISA for every child that has been in care whilst under the age of eighteen and who has been in care continuously for at least one year. This will give you a savings account with £200 to start with.

If you apply for benefits, there may be a period of time you have to wait before you receive your first payment. It is important that you don't fall into hardship during this period, so we will do the following to support you:

- Provide you with a support payment equivalent to income support / job seekers allowance if you're living independently or semi-independently and can't successfully make a claim for benefits yourself;

- Giving you an additional £ 30 a month clothing allowance if you're in receipt of benefits. This will be judged on a case by case basis;

- Providing emergency payments if you have been waiting for a benefits claim to be established for over three weeks;

- Providing you with a support payment equivalent to income support / job seekers allowance if you become ineligible for benefits whilst in further education.

Budgeting means having an understanding of your income (the money you receive) and your expenditure (the money you spend).

Your budget should act as flexible plan as some months you may have more money, for example when it is your birthday or other times you may have less money, for example Christmas or when you want to go on holiday. It is important you plan ahead and factor in these things to ensure you are one step ahead.

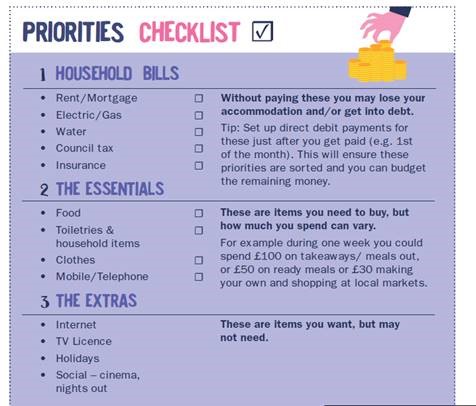

The following checklist is a valuable tool to help you understand the difference between the types of expenses you may come across.

After finishing college or your apprenticeship, you will need to find a job so you can continue to live independently. Your local job centre can support you to find work that will help you progress.

Your local job centre will also support you to deal with any changes to your benefits which you may experience through universal credit.

Contact details for officers at each Job Centre are as follows:

| Office | SPOCs | Telephone | |

| Carlisle | Richard Percival | Richard.percival@dwp.gsi.gov.uk | 01228 605075 |

| Whitehaven | Tova McNally

| Tova.mcnally@dwp.gsi.gov.uk | 01946 854075

|

| Workington | Kariss Ditchfield | Kariss.ditchfield@dwp.gsi.gov.uk | By email |

As set out earlier on in this Care Leaver Offer, the Council's digital badges scheme also includes badges on money management. Completing this badge will help to complement the skills you get from the 'Stepladder of achievement scheme'. Completing the badge will help you to build skills and knowledge in effective money management. Linked to this is an Open University course which you can access for free that helps you improve your budgeting skills. The budgeting course can be found through OpenLearn.

We have set out below what a typical bank statement looks like, this will help you understand the different types of payments that may come in and out of your bank account.

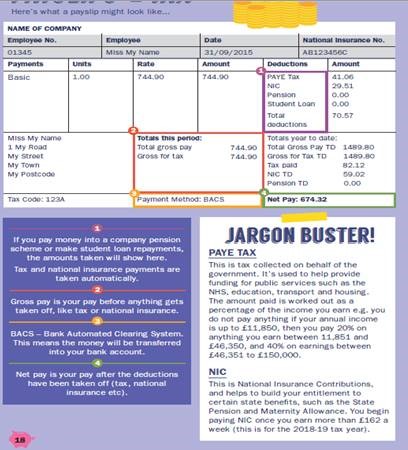

When you start to work, you will receive payslips which set out the money you have been paid and any tax or other deductions that have been made, this could be a student loan as an example. Set out below is what a typical bank statement looks like:

Credit Unions are member-owned financial institutions designed to offer more affordable sources of credit to those who may be on lower incomes. However, you need to remember that taking a loan from a credit union is still a form of debt, so it may be worth speaking to an advisor at the credit union and your personal advisor before applying for a loan. There are a number of credit unions in operation across Cumberland such as:

As a Care Leaver over the age of sixteen, you will be eligible for support in accessing benefits and welfare services. Accessing the benefits you are entitled to can help with the costs of day to day living which will give you more money in your pocket to do the things you enjoy. For more information on benefits services you can access, please visit the following links

State Benefits are sums of money paid by the Government to people in certain circumstances to meet their day to day living needs. They exist to make sure no one falls below a minimum standard of living. State Benefits are also sometimes called allowances, pensions, tax credits or entitlements.

There are many different benefits that can be claimed. If you have been told in the past that you do not qualify for benefits it is worth checking again. You can have capital (savings and property) adding up to £16,000 and still qualify for some benefits. It is important you get advice from your local DWP single point of contact officer as set out below, this will help to ensure that you are claiming every benefit that you are entitled to.

You should be careful about relying on benefits to protect against financial hardship. This is because:

- You can not be sure you will be entitled to get benefits at the time you need them;

- Benefits are fairly low, and might not pay you enough to cover the costs you face;

- In some cases, you have to wait before you can get help. For example, most people under 60 have to wait for 13 weeks before they can get help towards their mortgage costs.

Although it is sometimes necessary, borrowing money can be an expensive way of paying for something. If you take out a loan, you have to pay out interest meaning you pay more money for it.

Jargon Busting

Annual Percentage Rate (APR) - This is the average yearly cost of borrowing and includes interest, fees and other account running costs. The number the percentage number the more it is going to cost you.

Interest - A charge for the use of borrowed money.

Credit Limit - The maximum account of money you can borrow.

Credit Rating - Your credit rating is used to help lenders decide whether to lend you money, how much to let you borrow and, in some cases, how much interest to charge you. If your credit rating is not in the best shape there are things you can do to build it up again and fix any problems. More information and help can be found on the Money Advice Service's website.

Debit Cards are linked to a bank account, usually a current account. When you are 18 or over banks may offer you an overdraft (a way of borrowing money on your current account).

Credit Cards are designed for short-term borrowing, but they can quickly and easily get you into a lot of debt. Some companies offer new customers no interest for a certain amount of time but this could increase substantially later on.

You have a spending limit, but companies often increase this without your permission, which increases the temptation to spend more!

Store Cards often come with special offers, for example, 'sign up for a card now and get 10% off your shopping'. However, interest of over 10% is often charged, so it still works out a more expensive option. Often, stores charge more than 25% APR.

Loan sharks are not a community service and should never be used under any circumstances. Many loan sharks start out as a friend to their borrower but quickly change. If you have borrowed from an unlicensed lender you have not broken the law, they have. Seek advice as soon as possible and report the loan shark. Loans sharks often do the following:

- Rarely offer paperwork so those who borrow from them are kept in the dark about how much they still owe.

- Add additional amounts to the debt so the borrowers struggle to repay.

- Take items as security. These items could even include passports and bank cards.

- Resort to extreme methods to reclaim their debts. This could mean threats, intimidation, violence or worse.

Contact your personal advisor and the police as soon as possible if you feel pressured or are being contacted by a loan shark.

If you have a problem with debt, it is important not to panic but do not ignore it either - it will not go away.

To deal with your debts, you will need to do the following:

- Sort out how much money you owe;

- Work out which are the most urgent debts you need to pay off;

- Work out if you have got any money to pay your debts off and, if so, how much;

- Deal with the most urgent debts as a matter of priority;

- Look at your options for dealing with the less urgent debts and work out how to pay them off;

- Contact your creditors and make arrangements to pay back what you owe.

Debts you should prioritise include the following:

- Mortgage or rent

- Gas and electricity arrears

- Council tax

- Court fines

- Maintenance payable to an ex-partner or children

- Income tax or vat

- TV licence

- Tax credit overpayments

Regularly putting money into a savings account is a valuable way to ensure you can deal with unexpected situations when they occur. There are a number of reasons to have a savings account which include the following:

- Rainy-day funds - To pay for a repair to your home like a boiler replacement, washing machine or cooker.

- Funds for treats - To pay for treats such as a holiday, an expensive piece of furniture or Christmas.

- Financial protection - You might want to have a fund of money available in case you run into financial difficulties because you lose your job, become seriously ill, disabled or have an accident.

- Future spending - You might want to save up for something specific in the future such as a wedding, a new car or your retirement.

When you start working, you will need to make sure money goes into your pension fund to support you when you retire. A pension provides you with regular income when you stop working. The amount you regularly receive will depend on how much you save.

Depending on your employer, there should be a pension scheme you can enrol onto. However, if you have any questions, the money advice service's website has lots of information on pension options.

Scams are schemes to con you out of your money. They can arrive by post, phone call, text message, email or from someone coming to your home.

Remember - If something sounds too good to be true, it probably is!

There are a number of ways in which scams are delivered, these methods include the following:

- You get a call, text or letter you were not expecting;

- You are asked to give personal details or passwords. Your bank will never ask for full passwords, or your PIN code;

- You are pushed to make a quick decision. Scammers do not want to give you time to think;

- You are asked to make a quick decision;

- You are told to keep the payment a secret;

- You have never heard of a competition you are told that you have won.

If you think you have been a victim of a scam, please contact the police and your personal advisor as soon as possible